Automotive Motor Market Surpass USD 54 Billion: Overview

- The Global Automotive Motor Market is projected to grow from USD 24.3 billion in 2025 to USD 54.2 billion by 2032, with 11.8% CAGR.

- Surge fueled by EV adoption, hybrid growth, advanced motor tech, and electrification policies.

- Asia-Pacific leads (China, Japan, and South Korea); passenger cars dominate, and commercial vehicles are rising.

- Traction motors fastest-growing; key players include Bosch, Nidec, Continental, and Denso.

- Challenges: rare earth costs, supply volatility, integration complexity.

Automotive Motors: Powering a USD 54 Billion Market by 2032

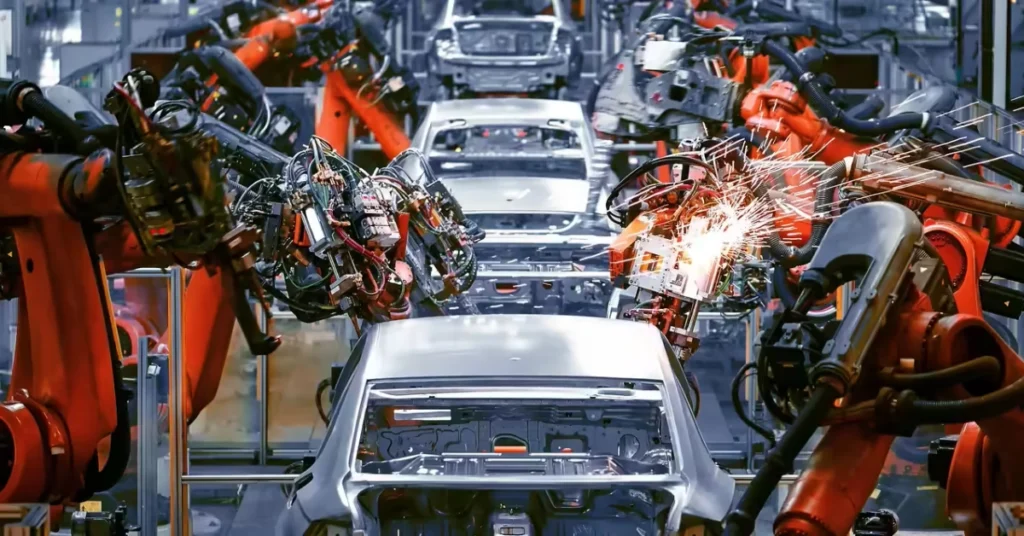

The heartbeat of modern vehicles is getting stronger and greener. According to the latest Introspective Market Research report released on December 18, 2025, the global Automotive Motor Market is set for explosive growth, expanding from USD 24.3 billion in 2025 to USD 54.2 billion by 2032 at a robust 11.8% compound annual growth rate. This surge transforms motors from hidden components into mission-critical stars, powering everything from silent EV propulsion to smart HVAC systems in an era of electrification and autonomy.

Traction motors for EVs, auxiliary motors for comfort features, and integrated solutions for hybrids are at the forefront. As Dr. Elena Martinez, Principal Consultant at Introspective Market Research, observed, “Automotive motors are the heartbeat of modern mobility. As vehicles transition from ICE to electric and hybrid platforms, motor innovation—both in efficiency and integration—is a defining factor for OEM competitiveness. Companies that lead in compact, high-performance, and low-cost motor solutions will capture the fastest-growing segments of this market.”

Market Segmentation and Revenue Outlook

| Segment | 2025 Base (USD Bn) | 2032 Forecast (USD Bn) | Notes |

|---|---|---|---|

| Overall Market | 24.3 | 54.2 | 11.8% CAGR; EV/hybrid shift dominant |

| Motor Type | Traction leading growth | Traction is the fastest | Traction for propulsion; auxiliary steady |

| Vehicle Type | Passenger cars dominant | Passenger + commercial rise | EVs boost passenger; fleets drive commercial |

| Region | Asia-Pacific’s largest | Asia-Pacific dominant | China/Japan/South Korea production hubs |

Asia-Pacific reigns on a massive scale in China, Japan, and South Korea. North America and Europe follow with premium tech and incentives. Passenger cars hold the revenue lead, but commercial vehicles accelerate via logistics electrification.

Key Growth Drivers and Emerging Trends

Several forces converge to fuel this expansion:

- Electrification Wave: EVs and hybrids demand high-torque, efficient traction motors.

- ADAS and Comfort Features: Auxiliary motors for steering, braking, and HVAC rise with connectivity.

- Micro-Mobility Boom: E-scooters and light vehicles create new niches.

- Policy Push: Subsidies, emissions rules, and zero-emission mandates worldwide.

Recent breakthroughs include

- Nidec high-efficiency traction motors with reduced size/weight.

- fleets andBosch integrated drive modules for hybrids.

- Denso e-axle solutions merging power electronics.

Challenges Facing the Market

Growth is strong but not without hurdles:

- Rare Earth Dependency: Permanent magnets drive up costs.

- Supply Volatility: Semiconductor and material shortages delay production.

- Integration Complexity: Advanced systems need precise calibration.

- Regulatory Variance: Differing standards complicate global planning.

The Bigger Picture: Motors as Mobility’s Core

By 2032, nearly every new vehicle will rely on multiple advanced motors. Traction systems will dominate revenue as EVs scale, while auxiliary motors support smarter cabins. Asia-Pacific’s production dominance will deepen, but innovation from Bosch, Nidec, and others ensures competition.

This market is not just growing—it’s evolving into the backbone of sustainable, connected driving. For OEMs and suppliers, mastering compact, efficient motors is the key to thriving in the electric age.

Source: timestech.in

Read more about Ev car News

Also Read

- MG Windsor Big Discounts Jan 2026: First-Ever Offers Make It Cheaper Than Launch Price

- JSW Motors To Enter Passenger Car Space In June With Rs 45 Lakh Plug-In Hybrid SUV

- Maruti Suzuki Second Car Plant Gujarat Investment: ₹4,960 Crore for 10 Lakh Unit Capacity

- India’s EV Sales Reach 2.3 Million Units in 2025, 8 Percent of New Vehicles: Strong Growth Led by Two-Wheelers

- VinFast Off to a Fast Start, Crosses 1k EV Sales in India: Milestone in Just Four Months

- What Happens To EV Battery After End-Of-Life?