Credits: electrive.com

JSW Group To Enter Indian Car Market: Overview

- JSW Group plans to launch its own car brand under JSW Motors by the end of 2026 (likely Q3 FY27).

- Focus exclusively on hybrid and electric vehicles to align with India’s clean energy shift.

- Currently partners with MG Motor India (51% stake since 2023); aims to increase shareholding for greater control.

- In talks with technology partners from China, Germany, the UK, and elsewhere for best-in-class tech.

- Positions JSW as an independent player with indigenous manufacturing ambitions.

JSW Group Accelerates Into Passenger Cars: Own Brand EVs and Hybrids Coming Soon

JSW Group, a diversified Indian conglomerate with a strong presence in steel, energy, infrastructure, cement, and paints, is gearing up for its biggest automotive leap yet. The group has confirmed plans to launch its own passenger vehicle brand under JSW Motors by the end of 2026, marking a shift from partnership to independent manufacturing. This new venture will focus exclusively on hybrid and electric vehicles, reflecting confidence in India’s growing demand for cleaner mobility solutions.

Since acquiring a 51% stake in MG Motor India in 2023, JSW has been selling both ICE and EV models under the MG badge. Now, the group seeks greater autonomy and indigenous production capabilities. Chairman Sajjan Jindal shared the vision: “At JSW Motors, we are bringing the best technologies from all over the world, not only from China, but also from Germany, the UK, and elsewhere. We are trying to work with the best technologies. We are targeting to launch our first vehicle sometime in the third quarter of the next fiscal year.”

Jindal also indicated intentions to increase JSW’s shareholding in MG Motor India for enhanced control, while the new brand operates as a separate entity dedicated to sustainable powertrains.

Why JSW is Betting Big on Clean Energy Cars

The decision to go hybrid and electric only is strategic:

- Aligns with India’s EV adoption push (FAME, PM E-DRIVE, state incentives).

- Taps growing consumer preference for lower running costs amid high fuel prices.

- Positions JSW to compete in a segment led by Tata Motors, Mahindra, and MG, with upcoming challengers like Maruti Suzuki and Hyundai.

- Leverages group synergies in steel (lightweight bodies) and energy (potential charging/battery tie-ups).

By sourcing the “best technologies” globally, JSW aims for a competitive edge in range, features, and pricing—crucial for mass-market success.

JSW’s Automotive Journey So Far

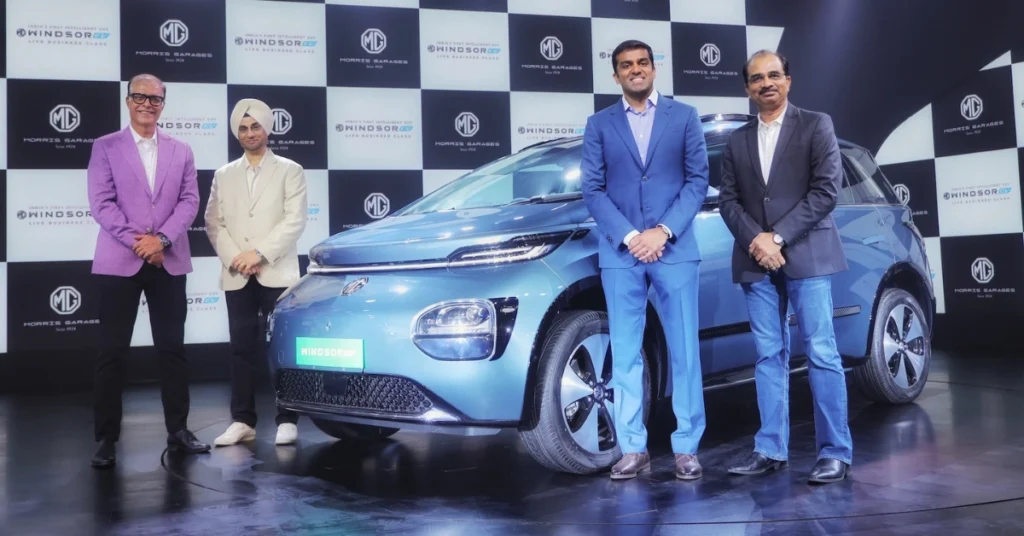

- 2023: Acquired 51% in MG Motor India, rebranding as JSW MG.

- Strong sales growth with models like Windsor EV, Hector, and ZS EV.

- Now: Independent brand with full control over design, tech, and manufacturing.

The move to indigenous production supports Make in India, potentially qualifying for PLI benefits and reducing import reliance.

What to Expect from JSW Motors

While details remain under wraps, the first vehicle (likely Q3 FY27) could target popular segments like compact SUVs or mid-size sedans—areas where hybrids and EVs are gaining traction. The future lineup may include:

- Affordable hybrids for price-sensitive buyers.

- Premium EVs leveraging global partnerships.

- Possible crossovers blending JSW’s rugged image with modern tech.

With the Indian EV market projected to grow rapidly (22 million units by 2035 per some reports), JSW’s entry adds healthy competition and choice.

The Bigger Picture: JSW’s Diversification Drive

From steel mills to car showrooms, JSW Group’s automotive foray is part of broader diversification. The clean-energy focus aligns with national goals and positions the conglomerate for leadership in sustainable mobility.

Challenges include building brand awareness from scratch and navigating policy shifts (GST, incentives), but JSW’s financial muscle and global tech tie-ups provide solid foundations.

As India accelerates toward greener roads, JSW Motors is ready to hit the accelerator—delivering vehicles that combine Indian ambition with world-class innovation.

Source: drivespark.com

Read more about Ev Car News

Also Read

- MG Windsor Big Discounts Jan 2026: First-Ever Offers Make It Cheaper Than Launch Price

- JSW Motors To Enter Passenger Car Space In June With Rs 45 Lakh Plug-In Hybrid SUV

- Maruti Suzuki Second Car Plant Gujarat Investment: ₹4,960 Crore for 10 Lakh Unit Capacity

- India’s EV Sales Reach 2.3 Million Units in 2025, 8 Percent of New Vehicles: Strong Growth Led by Two-Wheelers

- VinFast Off to a Fast Start, Crosses 1k EV Sales in India: Milestone in Just Four Months

- What Happens To EV Battery After End-Of-Life?