Image Source: thehindubusinessline.com

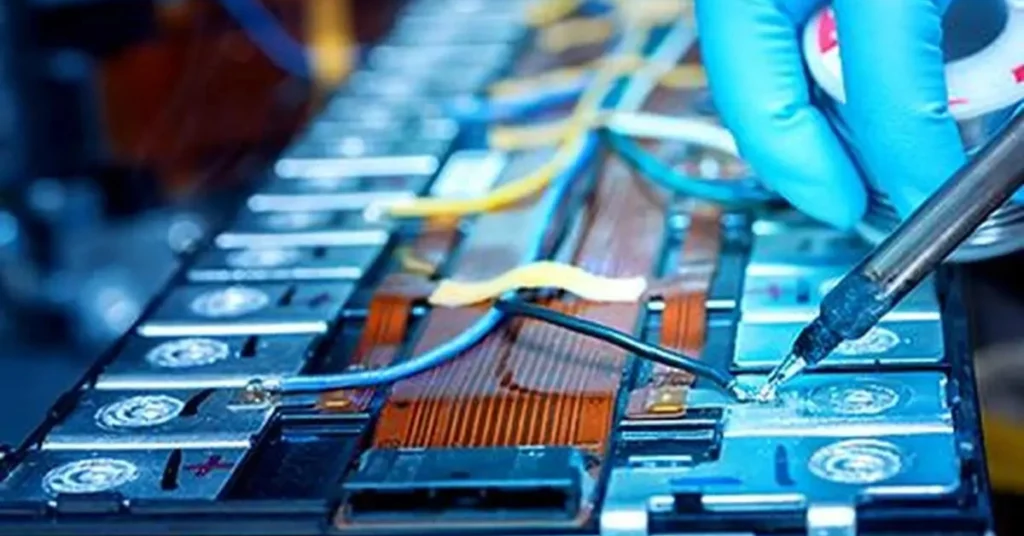

India EV Battery Demand 14-Fold Jump by 2032: Overview

- India’s EV battery demand is projected to surge from 17.7 GWh in 2025 to 256.3 GWh by 2032, a 14-fold increase with 35% CAGR, per the CES 2025 EV Battery Technology Review Report.

- Growth fueled by high fuel prices, consumer interest, new model launches, and policy support.

- LFP Gen 4 cells exceed 300 Wh/kg; sodium-ion and solid-state batteries are emerging for affordability, safety, and range.

- Challenges include China’s export controls on materials like synthetic graphite, high capex, limited minerals, and tech dependence.

- Calls for policy, investment, and collaboration to build a resilient domestic ecosystem.

India’s EV Battery Boom: 14-Fold Demand Surge by 2032 Signals Massive Shift

India is on the cusp of a battery revolution that could redefine its automotive and energy future. According to the 2025 EV Battery Technology Review Report by Customised Energy Solutions (CES), released on December 13, 2025, the country’s demand for electric vehicle batteries is set to explode from 17.7 GWh in 2025 to a staggering 256.3 GWh by 2032—a 14-fold leap representing one of the fastest clean-energy expansions anywhere. This seismic growth, driven by a 35% compound annual growth rate, stems from a perfect storm of rising petrol/diesel costs pushing consumers toward EVs, aggressive new model rollouts from manufacturers, and unwavering government policies like FAME and PLI schemes.

The report paints an exciting picture: breakthroughs in battery chemistry are not mere tweaks but transformative forces making EVs cheaper, safer, and capable of longer ranges. As Vinayak Walimbe, Managing Director at CES, put it, “Breakthroughs in battery chemistry are at the core of India’s EV revolution. Innovations like LFP Gen 4 and the emergence of sodium-ion technology are not just technical upgrades; they’re game-changers. They will make electric vehicles more affordable, safer, and able to go farther on a single charge.”

Hina Badgujar from CES added, “The next few years will be pivotal in shaping a sustainable future for our nation’s transport and energy sectors.” With two-wheelers, three-wheelers, cars, and commercial fleets all going electric, these advancements are perfectly timed to meet diverse needs—from budget commuters to premium highway cruisers.

Next-Gen Batteries: The Tech Driving the Revolution

The report spotlights rapid global R&D pushing boundaries in lithium-ion variants, advanced LFP, and NCM chemistries toward higher energy density and plummeting costs.

Key innovations include:

- LFP Gen 4 cells are now surpassing 300 Wh/kg, unlocking extended ranges (500+ km real-world) and potential price drops as cobalt/nickel use shrinks.

- Sodium-ion batteries are entering commercialization, offering a cobalt-free, low-cost alternative ideal for entry-level EVs and stationary storage.

- Solid-state batteries are on the horizon, promising even higher density, ultra-fast charging, and superior safety by eliminating liquid electrolytes.

These technologies cater to India’s unique mix: sodium-ion for affordable two/three-wheelers dominating sales, advanced LFP/NCM for passenger cars chasing 400-600 km ranges, and robust packs for e-buses/trucks in heavy-duty cycles. Indian manufacturers are responding with massive capacity ramps and chemistry diversification, aiming to capture the exploding domestic pie.

The Dark Clouds: Supply Chain Risks and Structural Hurdles

For all the optimism, the report sounds a cautionary note on vulnerabilities that could derail the trajectory without urgent action.

Foremost are China’s export controls on critical materials and know-how, particularly synthetic graphite—a key anode component. These restrictions are already delaying gigafactory timelines and inflating costs, exposing India’s supply chain to geopolitical shocks. With China dominating 90%+ of graphite processing, diversification is critical.

Other barriers include:

- Sky-high upfront capital for gigascale plants.

- Limited domestic reserves of lithium, cobalt, and nickel.

- Ongoing reliance on foreign technology transfers.

The report urges targeted policy interventions—incentives for mineral exploration, R&D grants for alternative chemistries, and diplomatic efforts for secure supply deals—alongside deeper industry collaboration to forge a resilient, self-reliant ecosystem.

Why This 14-Fold Surge Matters for Everyday India

A 256 GWh market by 2032 translates to millions more EVs on roads, slashing oil imports (worth billions annually), curbing urban smog, and creating lakhs of jobs in manufacturing, mining, and recycling. Cheaper, safer batteries mean EVs finally undercut petrol/diesel on total ownership cost, accelerating adoption beyond early enthusiasts to mass-market families.

For two-wheelers (80% of EV sales), sodium-ion could drop prices below Rs 50,000. For cars, LFP Gen 4 ranges rival diesel without refueling anxiety. Commercial fleets get reliable, low-maintenance packs for 24/7 ops.

CES, a pioneer of the India Energy Storage Alliance (IESA), has tracked this space since 1998, helping stakeholders navigate energy transitions.

The Path Forward: From Vision to Victory

The next few years are make-or-break. With global battery prices falling 15-20% annually and Indian firms like Reliance, Ola Electric, and Amara Raja scaling up, the foundation is strong. But overcoming China-dependent risks demands bold moves: domestic graphite synthesis, sodium-ion pilots, and solid-state consortia.

As the report concludes, India’s EV battery story is no longer “if” but “how fast.” With chemistry breakthroughs and policy resolve, that 14-fold jump could arrive even sooner, powering a cleaner, more energy-independent nation.

Source: telegraphindia.com

Read more about Ev Car News

Also Read

- MG Windsor Big Discounts Jan 2026: First-Ever Offers Make It Cheaper Than Launch Price

- JSW Motors To Enter Passenger Car Space In June With Rs 45 Lakh Plug-In Hybrid SUV

- Maruti Suzuki Second Car Plant Gujarat Investment: ₹4,960 Crore for 10 Lakh Unit Capacity

- India’s EV Sales Reach 2.3 Million Units in 2025, 8 Percent of New Vehicles: Strong Growth Led by Two-Wheelers

- VinFast Off to a Fast Start, Crosses 1k EV Sales in India: Milestone in Just Four Months

- What Happens To EV Battery After End-Of-Life?